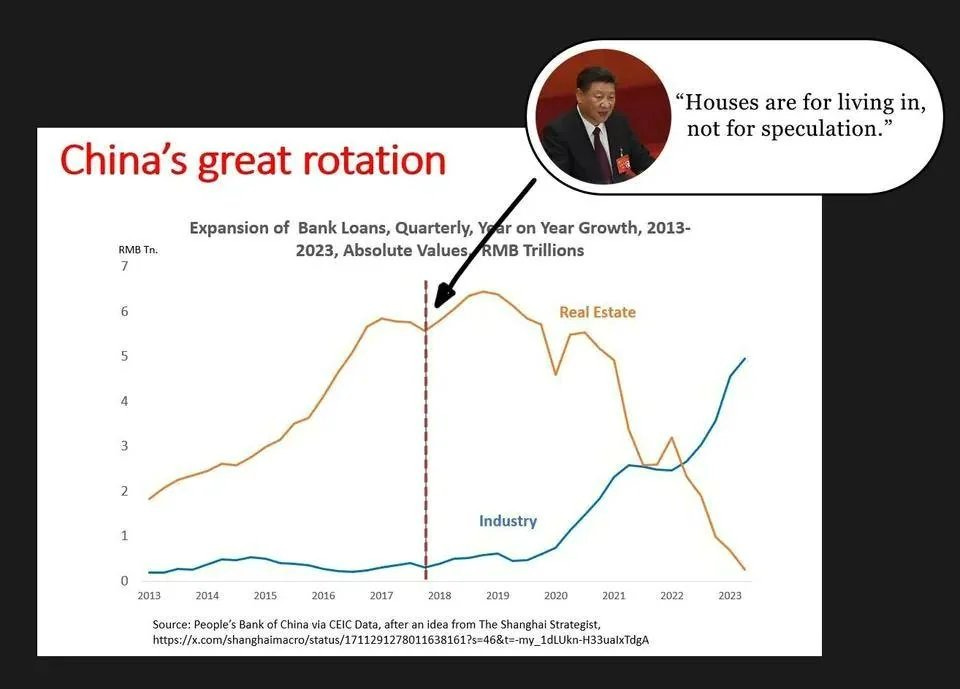

The Astonishing Reorientation of the Chinese Economy

From Real Estate to Industrial Development Within Five Years

Jason Smith on Twitter

Throughout the 2010s China was experiencing a quite colossal residential real estate boom, including extremely bubbly price appreciation, which toward the end of the decade the Party-state was striving to deflate in a controlled manner. From the turning of the decade onwards, it has been very successfully deflated. The sheer scale …

Keep reading with a 7-day free trial

Subscribe to Geopolitics And Climate Change to keep reading this post and get 7 days of free access to the full post archives.