The impacts of a Trump presidency are still not substantially known, and will very much depend upon who he selects as members of his cabinet and for other senior administration positions. Therefore, I have decided to refrain from commenting on most areas until we have a better handle on whether or not Trump’s rhetoric will become reality. One area that is pretty certain though is the probability of the increased use of tariffs, technology export restrictions etc., in an attempt to limit the “rise” of China. Therefore, this piece discusses the reality of the China and US relative positions, and the severe blind-spots that the US oligarchy and their courtier advisors have with respect to this reality.

In 2019 the academic Sean Kenji Starrs produced an excellent paper in Socialist Register entitled “Can China Unmake the American Making of Global Capitalism?” where he noted that a core contradiction of China was that its export industries were heavily controlled by and dependent upon foreign capital. It may have been the workshop of the world, but that workshop was heavily controlled by foreign firms who were able to keep the majority of the value added produced in China to themselves.

what is far less commented upon is the extent to which China’s export-driven boom is not only dependent on integrating into global capitalism, but is actually driven by foreign capital in key respects

The most well known case is that of Apple that has its products produced in China, but through the control of its supply chain and related intellectual property takes the vast majority of the value added for itself in the form of profits. There is a fundamental failure of economic statistics that assesses value added through price, counting the value added created in China as being created in the US; due to companies like Apple being able to drive down their foreign supplier prices. The result is that a significant amount of the Chinese value added is counted as US output, rather than captured within Chinese output. In essence, although China runs a monetary trade surplus with the US it is forced through predatory extractive practices based upon power differentials to export a chunk of its value added at knock-down prices; a classic case of unequal exchange.

When looking at Chinese exports up to 2017, Starrs found that Chinese privately owned enterprises (POEs) only controlled 10% of complex manufacturing exports, the share of Chinese state owned enterprises (SOEs) was even lower, and that Foreign Invested Companies (FIEs) controlled about 85%. In 2015, of the top 10 companies by Chinese exports six were Taiwanese, two were South Korean, and only two were Chinese. To escape the middle income trap China needed to reverse this reality, by climbing up the technology and supply chain ladders; hence the huge focus of the Chinese leadership on such upgrading. Reinforcing this focus were the US attempts to destroy firms such as Huawei which challenged the US leaders such as Apple.

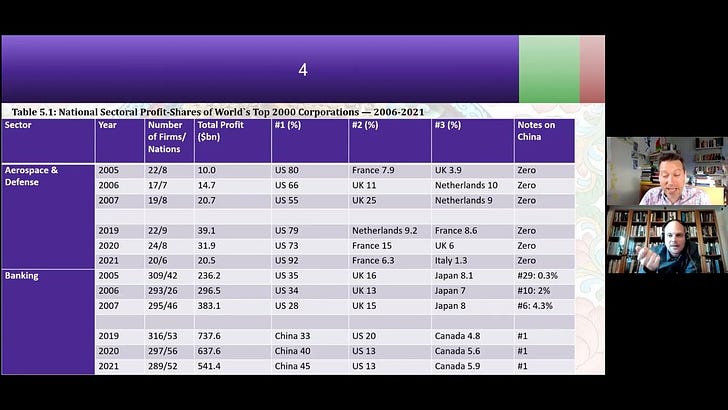

The great risk for the US is that China develops its own supply chains and brands and domesticates that value added, which will not only increase the bilateral trade deficit but also reduce US stated GDP as the foreign extraction of Chinese value added is erased. In addition, that domestic competitors start to displace foreign companies in the home market in complex manufactured goods and services. In the seven years since 2017, things have changed quite substantially and a base for a much faster transformation has been built. Below is a discussion with Sean Starrs where he points out the issue with national economic accounting as against understanding the ownership of capital with respect to who (and what nationality) benefits from economic value added. US firms not only extracted huge profits from China in the late 2010s, but US corporations and its oligarchy have massively expanded their ownership of European corporations; while US corporations remain overwhelmingly owned by other US corporations and US nationals. As the New Statesman put it with respect to the UK “From assets to businesses, the high street to the internet, US investors have a stranglehold on Britain’s economy.”

In the past decade, China has worked hard to overcome this US and foreign control. It has always protected the “commanding heights” of the economy from foreign, and even private, ownership; now sector after sector of the rest of the economy is removing foreign, and especially US, dominance.

One of the biggest transformations is of course in the automobile industry, where the domestic share of foreign brands accounted for nearly 65% of sales in 2020. A level which fell to 48% in 2023, and has already collapsed in 2024 to 33% and is continuing to fall. Within two years foreign brands may be only niche suppliers to the domestic market, most probably replacing the large profits that they were making with losses. China is also the largest exporter of cars, but much of those exports are produced for foreign car manufacturers who capture the majority of the value added. As the Chinese manufacturers reach total dominance of the domestic market in the next two years, their focus on exports will greatly increase; hence the preventative tariffs put in place in North America and Europe. As I have covered elsewhere this will only delay the inevitable given the competitive advantages of the Chinese manufacturers. More and more value added will be captured by Chinese companies. These statements by Starrs did not age well, made just before the start of the decline in foreign car brands in China:

in other key sectors China’s record has been poor in terms of learning from foreign capital in order to build national champions to eventually out-compete them. The most notable is in automobiles … As of 2014, foreign auto firms collectively held a 78 per cent market-share of passenger sedans in China, which indicated that after three decades Chinese industrial policy had still not established Chinese-controlled auto firms that can compete with foreign firms in China (let alone abroad).

Another area is that of smartphones, where Huawei had been growing its sales rapidly until the US government and US corporations conspired in an attempt to destroy it. Given Huawei’s dominance in 5G routers and related technologies, it was seen as imperative by the US oligarchy and its courtiers to destroy Huawei’s competitiveness.

It has taken a good few years for Huawei to recover, its sales fell from 40% of the Chinese market in 2015 to only 3.5% in 2020 and its foreign smartphone sales also collapsed. Samsung had already exited the Chinese market, but Apple remained as the dominant supplier of the much more profitable higher end smartphones (manufactured in China, sold in China, but the majority of the value added going to Apple in the US); from which it garnered the majority of the profits in the Chinese smartphone market.

After spending a number of years building its own supply chains to replace foreign technologies it had been banned from using, Huawei is now staging a comeback with 14% of the domestic smart phone market in the second quarter 2024. It was forced to focus everything on replacing the technologies that it had been cut off from; the US restrictions ended up driving Chinese technological development! And the biggest losers will be Western technology companies that will lose their sales in China, and around the world; with China now rapidly closing the gap with respect to the most advanced chips and ramping up to take market share in the less complex chips that serve the majority of the market. China was happy to buy foreign chips until the US imposed their technology export restrictions!

Huawei also spun off and sold its Honor brand to protect that brand from the sanctions against it, and that brand has 15% market share. With the Chinese vivo at 19%, the Chinese OPPO at 16% and the Chinese Xiaomi at 14%, Apple’s market share has fallen to 13%. The latter may get a boost around new product deliveries, but that will not stem the long term trend of greater competitive challenges and market share losses, as noted by Reuters:

Overall iPhone unit sales in China, however, dropped 2% year on year during the three-week period [since the release of its latest model] because of decreased sales of older models and increased competition with Huawei's Mate and Pura series

Especially when Huawei is stealing the technological cachet with products such as its Huawei Mate XT triple screen, dual foldable smartphone:

Huawei is now producing an AI chip comparable to the Nvidia H100, which is banned from China by the US. The half-lifes of the US technology sanctions are becoming shorter and shorter.

Even in domestic retail services, foreign brands are being displaced by domestic competitors - as with Luckin Coffee and Starbucks. Foreign brands are being challenged across the board, and China is no longer a money pot for foreign brands.

A report by the Australian Strategic Policy Institute that covers 64 “critical technologies spanning defence, space, energy, the environment, artificial intelligence, biotechnology, robotics, cyber, computing, advanced materials and key quantum technology areas” notes that China now leads in 57 of those key technologies (up from 52 in 2023). For a longer-term comparison, in the period 2003-2007 China was leading in just three critical technologies, and only 28 in the years 2013-2017 (which encompasses the start of the first Trump presidency). The technology relationship between China and the US is now very different to the one that Trump inherited as president in 2017; eight years is a long time in China time. We will see after his inauguration in January whether he and his advisors have any understanding of this new reality.

Against all the expectations that stemmed from the Trump technology export restrictions, which have been added to by the Biden administration, ASPI reports that China is now the leader in advanced integrated circuit design and fabrication! Or perhaps that is because of the export restrictions, as the Chinese state and corporations were galvanized to overcome the US attempt to stop their development in this area?

The US leads in Natural Language Processing, but China looks to quickly overtake it in that area. The US leads in Quantum Computing but China is catching up rapidly. Germany should be very worried about China’s enormous and increasing lead in high-specification machining processes as the production of machine tools is a major part of German manufacturing industry. Britain, France and Germany have also fallen far behind in advanced aircraft engines, as China wrested the lead from the US. And China is also the leader in drones, swarming and collaborative robots a very major future growth industry. Also, electric batteries, photovoltaics, advanced radio frequency communication, The US leads in genetic engineering, but once again China is second and close to overtaking the US.

Overall, China dominates in the following groupings of critical technologies:

Advanced information and communication technologies

Advanced materials and manufacturing

Artificial intelligence, computing and communications

Defence, space, robotics, and transportation

Energy and environment

Quantum technologies

Sensing, timing and navigation

Unique AUKUS relevant technologies

Autonomous underwater vehicles, electronic warfare, air-independent propulsion

The critical technology grouping of biotechnology, gene technologies and vaccines is the only one that is more balanced between the US and China; with the former leading in three critical technologies and the latter leading in four. The trend toward overall Chinese dominance in this critical technology area is already obvious.

The colossal technological and corporate leaps that the Chinese have made in the eight years since the start of the Trump presidency are nowhere near fully understood by the US and European elites (and Europe has fallen far behind both China and the US during that period). And the impacts of these leaps will intensify over time, as these advances are converted into increased competitiveness and sales. For example China’s first domestically developed F-class gas turbine, developed after eight years of intensive research and development, is bad news for the current Japanese, US and German suppliers. Then there is the utter shock of the Ford CEO at how far ahead the Xiaomi SU7 is of the products of his own company; he actually shipped an SU7 to the US for himself and doesn’t want to give it up! Showing an utter lack of self-insight in not understanding that he has shown why he should be immediately fired for his utter incompetence with respect to understanding his competition. And he is easily one of the better US CEOs.

The sheer speed of Chinese development has previously shocked the West, but as China draws level and overtakes that speed will be even more shocking to the Western elites. The Chinese moves to open up tourism have also produced a plethora of Western visitor videos showing utter shock at the advanced reality of China vs. the mainstream media propagandistic bullshit.

And of course in Xinjiang:

China is not just moving past the West in so many critical technologies, and capturing more and more of the value added produced by Chinese workers and corporations, but it is also starting to beat back the utterly ridiculous levels of Western mainstream media and state propaganda. Already in South East Asia, the elites are turning away from the US (aided by the US and Western support for the Zionist genocide) and toward China, and that trend will continue globally as China is seen more and more as a technological leader and driver of development; as against the decaying, bullying and warmongering US.

To answer Sean Starrs’ question, it may very well be that China has already won and the West is doing a good impression of Wiley E. Coyote as it hovers in mid air.

The West is running on fumes, and that reality has yet to be anywhere fully understood by the Western oligarchs and their courtier class. A good example of a new member of this courtier class is Zongyuan Zoe Liu, a young Chinese-born US PhD graduate (George Washington two-year MA and John Hopkins six-year PhD) who was quickly sucked into the Council of Foreign Relations (CFR) to write utterly propagandistic and delusional nonsense about China. Her latest piece in Foreign Affairs the in-house magazine of the CFR where the US courtier academics share the liberal hive mind views of the world is laughably entitled “Why China Won’t Give Up on a Failing Economic Model”. Yeah, the model which is driving it to dominate in so many critical technologies and to successfully develop its own brand name products; i.e. a highly competent and successful development state.

She claims that China suffers from “flagging domestic demand and industrial overcapacity [that together] form an economic doom loop that China must escape to avoid stagnation”, repeating that hive mind “overcapacity” meme. Then she tries to argue that helicopter money to consumers is much better than investing money in things that actually produce value added:

By largely excluding direct assistance to households as part of its stimulus plans, however, the government has demonstrated that it is still clinging to its old economic playbook of state-directed investment.

How dare the Chinese Party-state understand how to upgrade their economy and drive economic development! Then she attempts to construct some alternative reality where the Chinese population as a whole is experiencing hard times, because oh gosh:

By 2024, average disposable income had increased by only 50 percent since 2017—a dramatic slowdown from the previous era—and the timeline to double it again has stretched to an estimated 15 years

Attempting to compare this to “disposable income doubling approximately every eight years” in previous periods. Well firstly its only seven, not eight, years between 2017 and 2024 (nice sleight of hand there!) and there was this thing called COVID that may have had some impact upon growth during that period. But even taking her numbers, an increase in disposable income of 50% is not “hard times”.

The other issue is of course that China has become much richer, with a GDP per capita at PPP of US$24,500 in 2023, and growth will naturally slow down. At a 5% growth rate, incomes will double in about 15 years which is still incredibly fast vs. other nations; producing a 1.4 billion population in 2038 with an average income of nearly US$50,000; the same level as Poland, Japan and Spain currently. With a subset of the population at least equal in size to the US overall population most probably enjoying an equal or better standard of living. In the face of these actual facts, she even tries to manufacture a fake narrative:

For the first time since China’s economic reforms, many households worry that tomorrow may not be better than today—not because of personal failures but because of forces beyond their control.

She even uses increased visits to Buddhist temples as some econometric indicator of consumer woes! With a colossal logical leap and a massive pearl-clutching discursive flourish “many Chinese seem to place more faith in temple offerings or amulets than in the party’s assurances of common prosperity”. With “experts” like this in the liberal hive mind China just needs to sit back, continue with its current policies, grab some noodles and enjoy the show.

Trump may of course force the Party-state to act if he follows through on his threats of across the board tariffs and ever tightening technology export restrictions. China will respond with its own tariffs and restrictions on the exports of critical minerals and perhaps also other critical technology components. It is also considering a large stimulus package to replace lost US demand with domestic demand, and Chinese businesses will continue to diversify their exports. In addition, China can re-orient its food imports away from the US (and Canada) hitting one of the Republican Party’s core constituencies hard. With low inflation and so much growth potential, China risks little possibility of an “overheating” economy. And of course, the development state will double-down again on technology upgrading. US companies, including Apple, Starbucks, Tesla etc. should also expect a widespread souring of the Chinese population’s view of US brands with a probable acceleration in the rate of US (and European) brand replacement with domestic brands; keeping more and more of that value added at home.

With the majority of the US elite advisors most probably sharing the views of Zongyuan Zoe Liu, they may consider that China is economically weak and ripe for a good economic “lesson”. The reality is that it is the US that is much weaker, and very much unable to withstand higher tariff levels and inevitable resulting supply chain disruptions without increased inflation (made worse by domestic oligopolistic and monopolistic price gouging) and economic chaos; leading to increased unemployment and lower real wages for working people. Once again, the US will be carrying out self-harming actions due to the delusions of its oligarchy and courtier class.

In all of this, Europe will represent the “drive by shooting” victim caught in the crossfire as its vassal elites dutifully accept further punishment from their abusive liege.

A deep lesson in what’s up.

Its so far ahead of the West’s courtier class it’s shocking.

Fun news for those who like the truth.

"...Europe will represent the “drive by shooting” victim caught in the crossfire...". You've left me better informed, with some amusement as "a cherry on top". Thanks!